GST Return Filing is a must.The businesses registered under GST have to file returns monthly, quarterly and annually based on the category of business through the Government of India’s GST portal. They have to provide the details of the sales and purchases of goods and services along with the tax collected and paid.

Also read: Benefits Of Filing GST Returns On Time.

What is GST Return?

GST return is a document containing details of income that a registered GST dealer is required to file with the tax officials of, Government of India. Through this filing, the income of the registered GST dealer is ascertained and tax liability is calculated.

Generally, GST Returns include

– Purchases (Input)

– Sales (Output)

– Tax collected on purchases (Input Tax)

– Tax collected on sales (Output Tax)

In order to file GST Returns, invoices comprising of purchases and sales are required.

Who should file GST Returns?

GST Returns are to be filed by all the business entities that are registered dealers of GST. The type of GST returns to be filed depends upon the nature of the business of the registered GST dealer.

How many GST Returns are to be filed?

GST Returns are filed either monthly or quarterly and annually by the GST registered dealer, depending upon their nature of business and availability of options to file returns monthly or quarterly.

For regular taxpayers, two monthly returns and one annual return are to be filed. Therefore, in total 25 GST Returns are to be filed in a year.

For taxpayers opting Quarterly Return and Monthly Payment Scheme (QRMP), 8 quarterly returns and one annual return are to be filed. Therefore, a total of 9 GST Returns is to be filed in a year.

Note: Under the QRMP scheme, taxpayers having an aggregate turnover at PAN level up to Rs. 5 crores can opt for quarterly GSTR-1 and GSTR-3B filing.

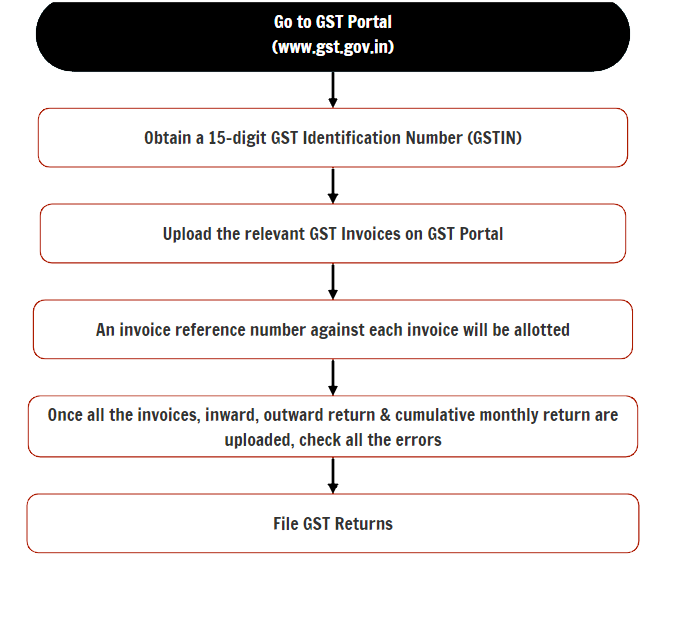

GST Returns filing process

Steps for Filing GST

- Step:1 Go the GST portal (www.gst.gov.in).

- Step:2 A 15-digit GST identification number will be issued based on your state code and PAN number.

- Step:3 Upload invoices on the GST portal or the software. An invoice reference number will be issued against each invoice.

- Step:4 After uploading invoices, outward return, inward return, and the cumulative monthly return has to be filed online. If there are any errors, you have the option to correct them and refile the returns.

- Step:5 File the outward supply returns in GSTR-1 form through the information section at the GST Common Portal (GSTN) on or before the 10th of the following month.

- Step:6 Details of outward supplies furnished by the supplier will be made available in GSTR-2A to the recipient.

- Step:7 Recipient has to verify, validate, and modify the details of outward supplies, and also file details of credit or debit notes.

- Step:8 Recipient has to furnish the details of inward supplies of taxable goods and services in GSTR-2 form.

- Step:9 The supplier can either accept or reject the modifications of the details of inward supplies made available by the recipient in GSTR-1A.

Final thoughts

The businesses registered under GST have to file returns monthly, quarterly and annually based on the category of business through the Government of India’s GST portal. if you are not filing gst on time it will lead to some complications. so file your gst correctly, on time. In this post we discussed simple method of GST filing. I hope you will get an idea about how to file the GST.