Latest Income tax slab rule changes and the latest income tax slab there are two main things which most of the people look for in Budget. I am sure you are also looking for detail about Latest Income Tax Slab FY 2021-22 (AY 2022-23). In this post, we will discuss key highlights of the Union budget 2021-22 and Income tax-related changes.

Union Budget 2021-22 was released by the Finance minister on 1st Feb 2021. The expectation from budget 2021-22 was very high. Salaried people were expecting Income tax slab change and other major reforms in budget but this year also budget 2021-22 was a big disappointment for taxpayers. in this post, we will discuss the Key highlights and Income tax changes, and new slabs.

Also read: How to Save Income Tax in India?

Union Budget 2021 -22 – Income Tax Changes

1.No ITR for Senior Citizens above 75 Years

As per the new rule, Senior Citizens above 75 Years of age and above need not file Income tax returns. This new rule is applicable only if senior citizens have income only from pension and interest. If senior citizens have other income such as rental income, business income, etc. still they need to file an income tax return.

Please note that the rule change is for not filing the Income-tax returns. This means senior citizens can avoid the process of filing returns. This does not mean that they have been exempted from Income tax. Income tax is applicable as per the actual tax slab rate. You must be aware that under section 80TTB, the senior citizens can claim up to Rs.50000 interest received from the bank and post office as an exemption from tax. It is a welcome to step for the senior citizen.

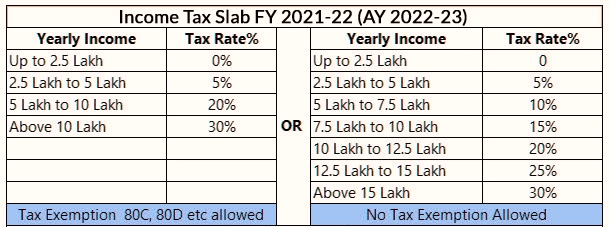

2.Latest Income Tax Slab FY 2021-22 (AY 2022-23)

The latest Income tax slab for FY 2021-22 is the same as that of FY 2020-21. This means there is no change in the income tax slab for FY 2021-22. The old rate and slab will continue in FY 2021-22 (AY 2022-23). The new simplified tax regime will continue. If you have adopted a new tax regime last time where the tax rate is lower and flat you cannot claim any tax exemption such as 80C, 80D, etc.

In case you have continued with old tax slab, you can invest in tax saving instrument under section 80C, 80D etc. and pay tax at higher rate. In short two types of tax slabs announced last year will continue.

- Tax regime at lower tax rate without any IT deduction and exemptions

- Tax regime at higher tax rate with IT deduction and exemptions

Latest Income Tax Slab for FY 2021-22 is given below.

3.Section 80EEA available up to March 2022

The earlier announced benefit of section 80EEA shall be available up to March 2022. Under section 80EEA the interest amount up to Rs.150000 for housing loan taken for affordable housing from 1st April 2019 to 31st March 2020 was exempted. Now, this benefit will be available up to March 2022.

4.ULIP Maturity Amount Taxable

On ULIPs with a premium amount of 2.5 Lakh per annum or more, the maturity amount, which was earlier tax-free under Section 10(10D) of the Income Tax Act, will now be taxable. However, in case of the unfortunate death of the insured person, the death benefit will continue to remain tax-free. In simple words, from now onwards ULIP would attract 15 percent short-term capital gains tax (STCG) or 10 percent LTCG depending on the holding period.

5.EPF & VPF Interest Amount Taxable

As per the budget 2021 announcement, from 1st April 2021 EPF interest on any contribution above 2.5 Lakh by an employee to PF is taxable as per the applicable tax slab. The new rule is applicable for EPF as well as VPF contribution amount.

6.Reopening ITR period reduced

As per old law, ITR can be opened again and inquiries can be sent to taxpayers for the last 6 income tax returns,s and for serious fraud cases this limit is up to 10 Years. In the budget, this limit is reduced. As per the new income tax rule, the ITR can be opened only for up to 3 years. This means the taxpayer needs to keep all financial documents intact for up to the last 3 years only. In case of serious fraud up to 50 lakh amount, the limit remains as it is 10 years.

Final Thoughts

Income tax slab rule changes and the latest income tax slab there are two main things which most of the people look for in Budget. in This post we discussed the details about Key highlights and Income tax changes and new income tax slabs. I hope this post will give an idea about latest income tax slabs.

Pingback: Section 80EEA – Deduction for interest paid on home loan for affordable housing - finvestfox.com