Section 80EEA was introduced in the Finance Bill of 2019, as per this rule, the interest paid on housing loan which is taken between April 1, 2019 – March 31, 2020, is eligible for deduction starting from assessment year fiscal 2020 – 2021. In this post, we will discuss the 80EEA section and its features and details.

Also read: Latest Income Tax Slab FY 2021-22 (AY 2022-23)

Housing for All and the introduction of Section 80EEA

In its first term that started in 2014, the prime minister Narendra Modi-led NDA government launched its pet ‘Housing for All by 2022’ program. With the same objective, it also announced the launch of the Pradhan Mantri Awas Yojana (PMAY), to incentivize house purchase through subsidies offered by the center. In order to complete the ambitious target that it had set for itself, the central government further launched several measures, to encourage first-time home buyers. The introduction of Section 80EEA in 2019, was a step in that direction.

With a view to achieving the target of Housing for All by 2020, the government extended the interest deduction under Section 80EEA for loans taken during the period between April 1, 2019, and March 31, 2021, and subsequently till March 31, 2022.

What is Section 80EEA of the Income Tax Act?

Section 80EEA was introduced by Finance minister Nirmala Sitharaman in the 2019 Union Budget with an aim to give a boost to the center’s ‘Housing for All by 2022’ program, by way of offering additional tax benefits on the purchase of affordable homes.

“In computing the total income of an assessee, being an individual not eligible to claim deduction under Section 80EE, there shall be deducted, in accordance with and subject to the provisions of this section, interest payable on loan taken by him from any financial institution for the purpose of acquisition of a residential house property,” reads Section 80EEA.

Income tax deductions for interest paid on home loan

Eligible Deduction Amount

Individuals who are paying housing loans can claim for deduction on interest payment of up to Rs 1,50,000 per annum under Section 80EEA. This deduction is over and above the deduction of Rs 2,00,000 per annum for interest amount payments which is available under Section 24 of the Income Tax Act. Individuals are eligible to claim a total deduction of Rs 3,50,000 per annum for interest on the home loan if they meet the prerequisites of Section 80EEA of the Income Tax Act.

Eligibility Criteria

Deduction under Section 80EEA is applicable only to individuals. Other including Hindu Undivided Family, firms, partnerships, companies, the association of persons cannot claim this benefit under this section in the Income Tax Act. Apart from this individual who is claiming deduction under Section 80EEA should not be owing to any other house property on the date of sanction of the loan amount.

Conditions for claiming the deduction

- A housing loan must be taken from a financial institution or a housing finance company for buying a residential house property.

- The stamp duty value of the house property should be Rs 45 lakhs or less.

- The individual taxpayer should not be eligible to claim deduction under the existing Section 80EE.

- The taxpayer should be a first-time homebuyer. The taxpayer should not own any residential house property as of the date of sanction of the loan.

Conditions with respect to the carpet area of the house property. These conditions have been specified in the memorandum to the finance bill, but not mentioned in section 80EEA:

- The carpet area of the house property should not exceed 60 square meters ( 645 sq ft) in metropolitan cities of Bengaluru, Chennai, Delhi National Capital Region (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (the whole of Mumbai Metropolitan Region)

- The carpet area should not exceed 90 square meters (968 sq ft) in any other cities or towns.

- Further, this definition will be effective for affordable real estate projects get approve on or after 1 September 2019

Section 80EEA has been introduced to further extend the benefits allowed under Section 80EE for low-cost housing. Earlier, Section 80EE had been amended from time to time to allow a deduction for interest paid on housing loans for FY 2013-14, FY 2014-15, and FY 2016-17. The section does not specify if you need to be a Resident to be able to claim this benefit. Therefore, it can be concluded that both Resident and Non-Resident Indians can claim this deduction. The section also does not specify if the residential house should be self-occupied to claim the deduction. So, borrowers living in rented houses can also claim this deduction.

NOTE:

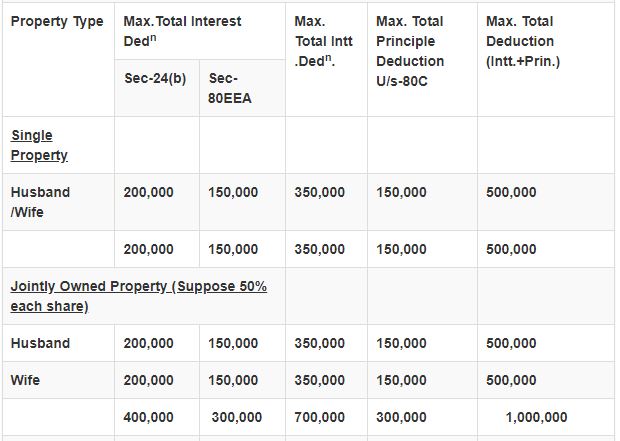

the deduction can only be claimed by individuals for the house purchases jointly or singly. If a person jointly owns the house with a spouse and they both are paying the installments of the loan, then both of them can claim this deduction. However, they must meet all the conditions laid down.

Home Loan Tax savings in case of joint ownership

If Property is jointly owned by Husband and Wife and they both are paying installments, both of them are eligible to claim deduction u/s-24(b) and u/s-80EEA in their respective ITR for their share, if conditions specified in these sections are satisfied.

Section 80EEA and Section 24

Under Section 24, homeowners can claim a deduction for interest payments up to Rs 2 lakh on their home loan, if the owner or his family resides in the house property. The deduction of up to Rs 2 Lakh applies even when the house is vacant.

If you have rente out the property, the entire home loan interest is allowed as a deduction. If you are able to satisfy the conditions of both Section 24 and Section 80EEA of the Income Tax Act, you can claim the benefits under both sections.

First, exhaust your deductible limit under Section 24, which is Rs 2 lakh. Then, go on to claim the additional benefits under Section 80EEA. Therefore, this deduction is in addition to the Rs 2 lakh limit allowed under Section 24.

Also read: How to Save Income Tax in India?

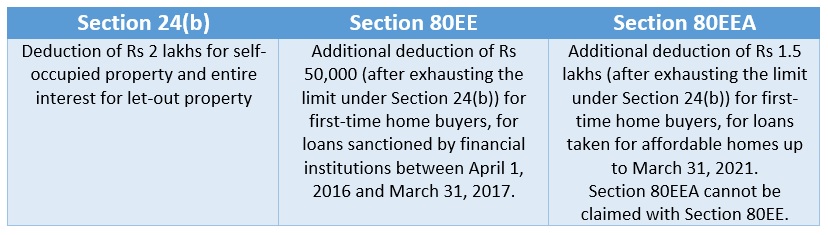

What is the difference between Section 80EEA and Section 24(b)?

Buyers can claim deductions under both, Section 24(b) and Section 80EEA, and enhance their total non-taxable income to Rs 3.50 lakhs, if they meet the eligibility criteria. However, deductions under Section 80EEA can only be claimed after exhausting the Rs 2-lakh limit under Section 24(b).

| Category | Section 24(b) | Section 80EEA |

| Possession | Must | Not required |

| Loan source | Banks or personal sources | Only banks |

| Deduction limit | Rs 2 lakhs or entire interest* | Rs 1.50 lakhs |

| Property value | No specification | Rs 45 lakhs |

| Loan period | Loans took after April 1, 1999 | April 1, 2019, to March 31, 2021 |

| Buyer category | All home buyers | First-time individual home buyers |

| Lock-in period** | None | None |

**Section 80C specifies that buyers should not sell the property for five years, to claim deductions. This is known as the lock-in period.

What is the difference between Section 80EEA and Section 80EE?

First-time buyers claiming deductions under Section 80EE cannot claim deductions under Section 80EEA. This is specifically mentioned in the law.

| Particulars | Section 80EE | Section 80EEA |

| Property value | Up to Rs 50 lakhs | Up to Rs 45 lakhs |

| Loan amount | Up to Rs 35 lakhs | Not specified |

| Loan period covered | April 1, 2016 to March 31, 2017 | April 1, 2019 to March 31, 2021 |

| Maximum rebate | Rs 50,000 | Rs 1.50 lakhs |

| Lock-in period | None | None |

Final Thoughts

Section 80EEA allows you to get a reduction in the interest paying on the housing loan. there is a lot of things to note about section 80EEA. In this post, we made a detailed study on section 80EEA. I hope this post will give you a good idea about this section and its details. make youse of the section 80EEA if you are a taxpayer and also a home loan repayer

Happy Tax filing