Aadhaar PAN Linking becomes mandatory. your income tax return will not be processing if the Aadhar is not in link with PAN. Also, if you have to carry out a banking transaction above ₹50,000, you have to link Aadhar and PAN. Aadhaar PAN Link is very important for other financial activities too. in this post, we will discuss how to link the Aadhar with PAN.

Also read: How to do Aadhaar-PAN linking Online

How to check if PAN is Linked with Aadhaar or not?

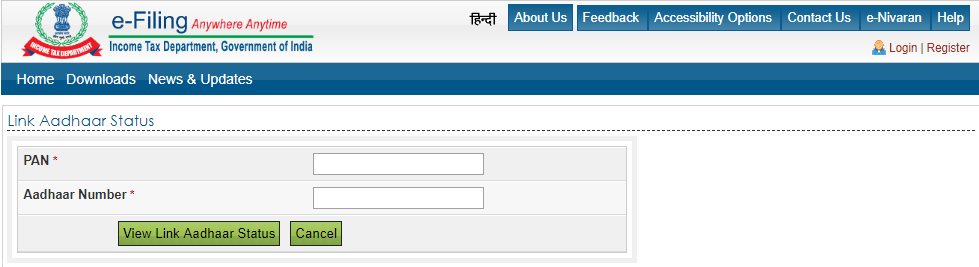

- Visit the e-Filing Income Tax Department page – click here

- Enter the PAN Number.

- Enter the Aadhaar Number.

- Click the ‘View Link Aadhaar Status’ button.

- The Aadhaar-PAN link status will be appearing on the screen.

If your Aadhaar and PAN are linked, you will see a message like this,

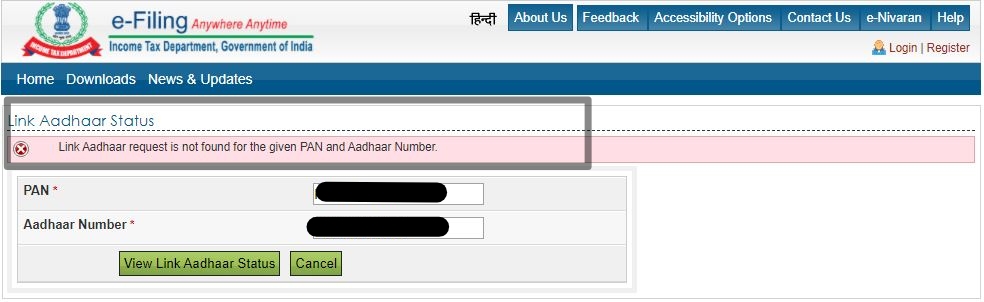

If your Aadhar and PAN are not linked, it will show like this,

Importance of Aadhaar-PAN Linking

- Linking PAN with Aadhaar will help in tackling multiple PAN cards issued in the same name.

- The user will get a summary detail of taxes levieing on him and it will be useful for future reference.

- All PAN cards that are not in link with Aadhaar will be deactivating soon.

- Your income tax return form will not be processing if your PAN is not in link with Aadhaar.

Aadhaar PAN Linking Exceptions

You are exempted from linking your Adhaar and PAN if;

- Senior citizens, who are more than 80 years old at any time during the financial year.

- You are an NRI.

- Residents of Assam, Meghalaya, and Jammu & Kashmir.

- Foreign nationals residing in India.

Note: before linking your Adhaar and PAN make sure that the details in both documents are the same. i.e. your name, date of birth, etc. must be the same in both documents. if not the Linking process will not be completed. so if there any errors in your Adhaar or PAN make needful corrections before you start the linking process.

Final Thoughts

The Government of India is making it mandatory to link the Adhaar and Pan. if you are not linking you have to face many difficulties on your financial side. like income tax return filing. bulk money transaction etc. most importantly your PAN may get deactivated if you are not linking it with Aadhar. so Link your aadhar and pan as soon as possible.