Aaadhar PAN Link becomes mandatory. your income tax return will not be processed if the Aadhar is not linked with PAN. Also, if you have to carry out a banking transaction above ₹50,000, you have to link Aadhar and PAN. Aadhaar PAN Link is very important for other financial activities too. in this post, we will discuss how to link the Aadhar with PAN.

Importance of Aadhar-PAN Linking

- Linking PAN with Aadhaar will help in tackling multiple PAN cards issued in the same name.

- The user will get a summary of details of taxes levieing on him and it will be useful for future reference.

- All PAN cards that are not linked with Aadhaar will be deactivated soon.

- Your income tax return form will not be processing if your PAN is not linked with Aadhaar.

How to do Aadhaar-PAN linking Online

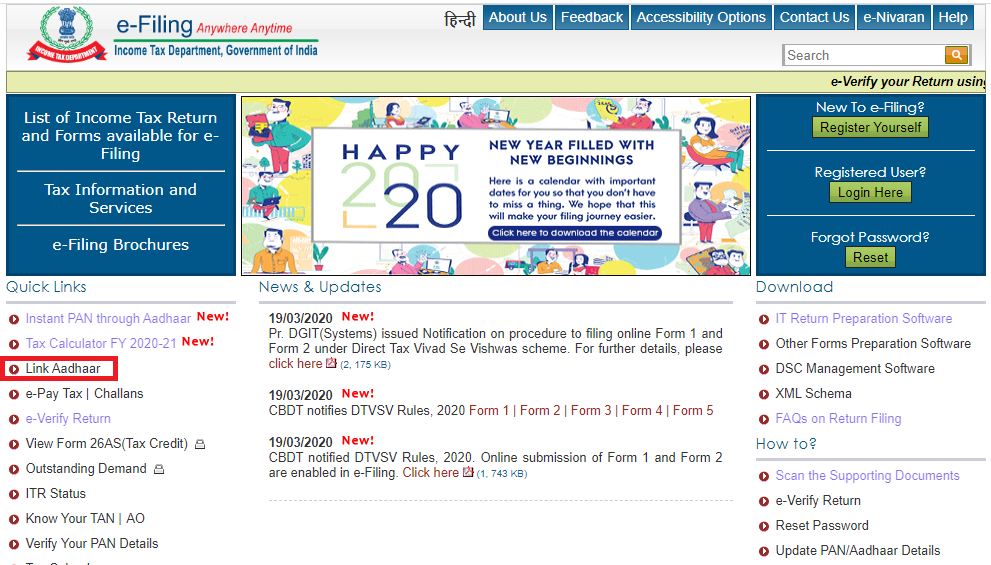

- Go to Income Tax e-Filing website and click on ‘Link Aadhaar’ option under the quick links.

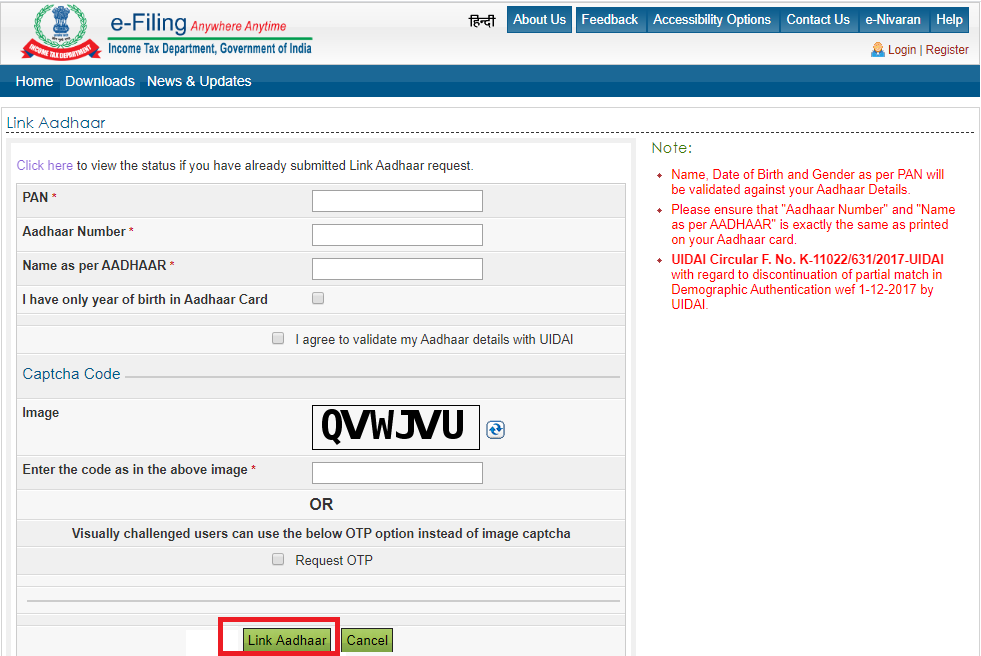

- Enter the PAN and Aadhaar number.

- Enter the name exactly as mentioned in the Aadhaar card.

- If, only year of birth mentioned on your Aadhaar card and you have to tick the square.

- Make a tick, ‘I agree to validate my Aadhaar details with UIDAI’.

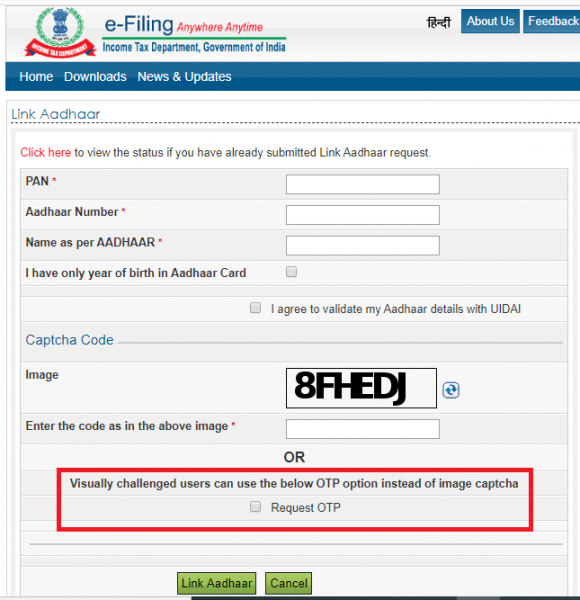

- Submit the ‘Captcha Code’ correctly mentioned in the image for verification.

- Click on the ‘Link Aadhaar’ button.

- A pop-up message will be showing that your Aadhaar is successfully linked with your PAN.

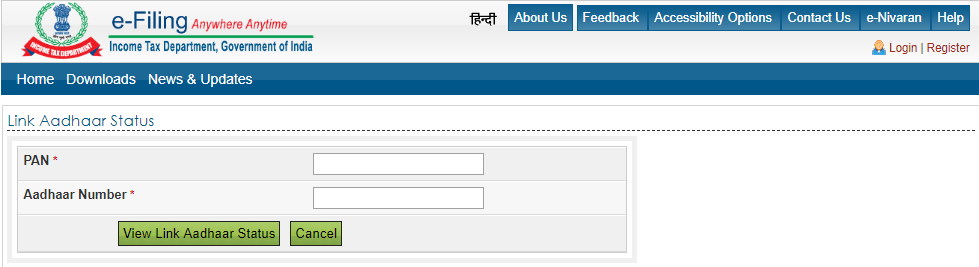

How to Check the Aadhar PAN Link status

- Visit the e-Filing Income Tax Department page – click here

- Enter the PAN Number.

- Enter the Aadhaar Number.

- Click the ‘View Link Aadhaar Status’ button.

- The Aadhaar-PAN link status will be appearing on the screen.

Correction Facility for Aadhaar PAN linking

Aadhar-PAN linking becomes successful only when all the details in both matches. In case there are errors like spelling mistakes in your name, your PAN will not be linking with the Aadhaar. You can make needful corrections easily by going to a nearby Aadhaar Enrolment Centre or you can visit the online portal of NSDL PAN. you can correct them by following steps:

- The user can correct the PAN details using the NSDL website.

- The NSDL link will be redirecting you to a page where you can apply for the correction of your name.

- Produce signed digital documents for updating your PAN details.

- After correcting your PAN details and confirmed by NSDL by email, you can link your PAN with Aadhaar.

Unable to Link PAN with Aadhaar? Here’s What to Do

The Government of India making it mandatory for all individuals to link PAN card with Aadhaar card before the deadline (i.e.31st March 2021) as failure to link the both will result In deactivation of PAN by the Income Tax Department, also you will not be to file Income Tax Returns, etc.

Importantly, your name In both the Aadhaar and PAN must be the same. If there is a spelling mismatch, you cant link both. You have to correct your name. then only you will be able to do the linking process.

Case 1: your name on the Aadhaar card is not correct, follow these steps to make it correct:

- Visit an Aadhaar Enrolment Centre

- produce a self-attested copy of your Identity proof.

- Fill in the Aadhaar Enrolment Form.

- Submit the form with the needful documents.

- You will get an Update Request Number with an acknowledgment slip.

- You can use this URN for checking the status of the update request.

- After your update request is processed and the correction is done, you can do the linking process.

Case 2: your name in the PAN card is not correct, follow these steps to make it correct

- Visit the e-filing website of NSDL click here.

- Click the ‘Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)’ option from the drop-down menu.

- Choose the individual category and enter your details.

- Make the payment. then submit your form online after Aadhaar e-KYC.

- After this, your new PAN will be sending to your address.

- when you receive your PAN, you can link it with your Aadhaar.

Aadhaar PAN Linking Exemptions

You have exemption from linking your Adhaar and PAN if;

- Senior citizens, who are more than 80 years old at any time during the financial year.

- You are an NRI.

- Residents of Assam, Meghalaya, and Jammu & Kashmir.

- Foreign nationals residing in India.

Final Thoughts

The Government of India is making it mandatory to link the Adhaar and Pan. if you are not linking you have to face many difficulties on your financial side. like income tax return filing. bulk money transaction etc. most importantly your PAN may get deactivated if you are not linking it with Aadhar. so Link your aadhar and pan as soon as possible.