How to Save Income Tax ? every salaried person asks this question because of the tax load on them. we know that income tax is charged on different slabs. so people are worried about paying high-income tax according to their salary. there are many legal ways to evade the income tax burden. some people don’t mind about income tax and they pay. but some other people do their tax planning brilliantly. in this post, we will discuss how to save income tax in India.

Also read: Countries without income tax-The Income tax Heavens

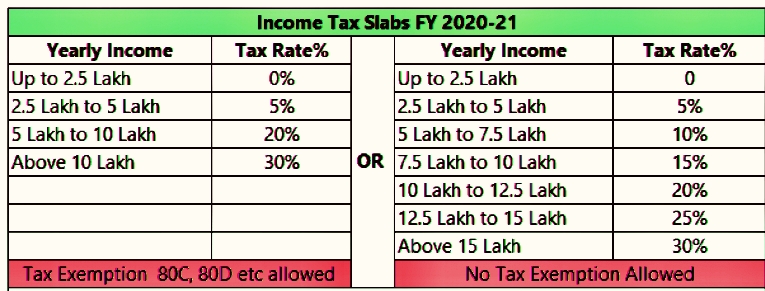

Income Tax Slab

As per the new revision of the finance ministry, there are two income tax slabs that are applicable now. The old tax slab will allow the taxpayers to save tax money by investing in the tax-saving investing instruments. The new tax slab is very simple. Taxpayers need not make any investment and they can enjoy a lower tax slab rate. The new tax slab will be more suitable for the upper-middle group who do not make any investment for saving tax. The tax slab in FY 2021-22 is given below.

How to Save Income Tax in India

There are many legal methods are there to reduce the tax load. following are the most popular methods used for reducing tax. this includes investments, insurance, loans Etc.

Section 80C – Up to ₹1.5 Lakh can be saved under section 80C

If you utilize your section 80 C limit. You can save Tax up to ₹1.5 lakh by investing in various tax saving instruments under section 80C. The details of tax-saving plans with tax-saving benefits are listing below.

- ELSS – ELSS (Equity Linked Savings Scheme) is a special type of mutual fund popular as an equity-linked saving scheme. You can make an investment in ELSS through a lump sum or SIP method. ELSS funds are locking funds with a lock-in period of 3 years. The long-term capital gain that is applicable on the ELSS is 10%.

- Tax Saving Fixed Deposit – This is one of the best tax-saving instruments. Tax saving FD is for the investors who don’t want to take risks. also, this instrument will be having a lock-in period of 5 years.

- Public Provident Fund (PPF) – Public provident fund is considering as one of the most secure investment options. PPF is a long-term investment option. The main benefit of PPF is it falls under the EEE category. You can save up to ₹1.5 Lakh per annum by investing in PPF.

- Life Insurance Premium – Life insurance premium payment for self and family members is eligible for deduction under section 80C. This is applicable for all types of insurance policy such as term plan, ULIP, endowment policy, etc.

- Home Loan – You can get the benefit of home loan principal repayment under section 80C. ₹1.5 Lakh is the maximum amount allowed on capital annually.

- Tuition Fees – Tuition fees paid at school for child education can be claimed for a tax deduction by parents under section 80C.

- Sukanya Samriddhi Scheme – You can make an investment in the Sukanya Samriddhi scheme and claim tax benefit for the amount contributed toward SSY.

- Senior Citizen Saving Scheme – Senior citizen saving scheme fixed deposit is a special scheme for the senior citizen. The senior citizen can get a higher interest rate on SCSC. One can claim a tax deduction by investing in SCSS.

- Employees Provident Fund –(EPF ) Any contribution making in the employee provident fund will be eligible for the tax exemption under section 80C.

National Pension System (NPS) section 80CCD

By making an investment in NPS, you can claim an additional tax benefit of ₹50000 under section 80CCD. You will have to open an NPS account and do the investment. The contribution will have to be last up to the age of 60 in the NPS account.

Health Insurance Premium section 80D

The health insurance premiums paying towards self and family members up to ₹25000 are eligible for the tax exemption. For a senior citizen, the maximum limit is ₹50000. For self and senior citizen parents, the maximum limit together is ₹75000.

Repayment of Interest towards a Home Loan

The repayment of the interest on a home loan is eligible for a tax deduction. The maximum amount for the tax deduction eligibility for home loan repayment is ₹ 2 Lakh. This amount is an additional amount on the top of ₹1.5 Lakh amount eligible for section 80C.

Interest earned in saving account

The interest income up to ₹10000 on the saving account per financial year is eligible for tax exemption. This is as per section 80TTA. The limit of the tax exemption is higher for the senior citizen it is ₹50000 under section 80TTB.

Donation under section 80G

If you are making donations, you can claim tax benefits under section Section 80G. we can make the donation through any organization including political and religious or charitable organizations that gives a receipt under section 80G.

Repayment of Education Loan section 80E

The interest component paying for the education loan is eligible for the tax exemption. There will not be any upper limit on the interest repayment of education loans.

Final Thoughts

How to Save Income Tax? the most searched topic by Indians always. people want to save their tax amount and reduce the tax load by dong legal and government allowed methods. some people use these methods some others don’t. nowadays many people plan their taxes effectively to reduce the tax load. in this post, we discussed genuine and legal methods to save the Income-tax in India. these methods are legal and approved by the government of India.

Pingback: Latest Income Tax Slab FY 2021-22 (AY 2022-23) - finvestfox.com