Penny Stocks Multibaggers are one of the best quick money-generating tools. but as we all know it is very risky to trust and invest in penny stocks. penny stocks are famous for emptying one’s capital too. there are many examples of such incidents. at the same time, few penny stocks are performing well and giving amazing returns. in this post, we will discuss 5 penny stocks that are performing well and have become a multi-bagger in the last year.

IMPORTANT NOTE: this is not a buying suggestion. in this section, I am just explaining 5 stocks that become multi-bagger. I am not suggesting buying any of these companies’ shares. the price of these shares may go up or down depending on the conditions and performance. so take these stocks for education purposes only.

What is a Penny stock?

Penny stocks are stocks that are trading at a lower price. according to the Indian stock market stocks below ₹10 are considering penny stocks. sometimes according to ints movements stocks below ₹20 are also included in this slot. These shares are mostly offering by companies with lower market capitalization. Therefore, these are also called nano-cap stocks, micro-cap stocks, and small-cap stocks, depending on the company’s market capitalization.

5 penny stocks that became multi-baggers in 2021

Following are the 5 Penny Stocks Multibaggers become multi-bagger in 1 year of time span. these 5 stocks give huge returns to their investors.

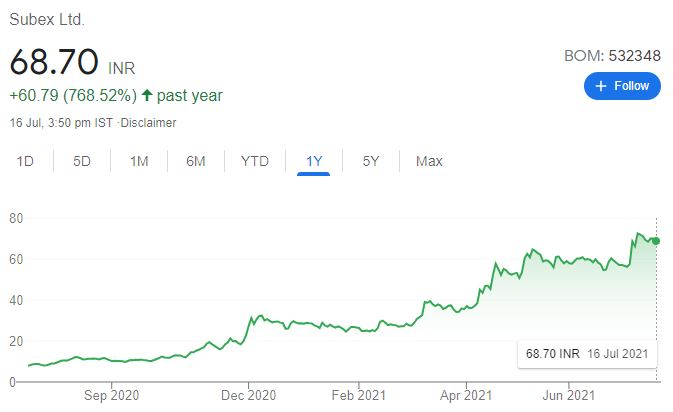

1.Subex

Subex is Bangalore based Software Company that provides digital products to communication service providers. subex is focusing on the telecommunications industry and providing digital trust products to communication services providers. on 17 July 2020, the stock price of Subex was trading at ₹7.91. after one year, today ie on 16 July 2021 the stock price of subex is ₹68.70. it becomes a multi-bagger last year and gave a return of 6.86 times,768.52%.

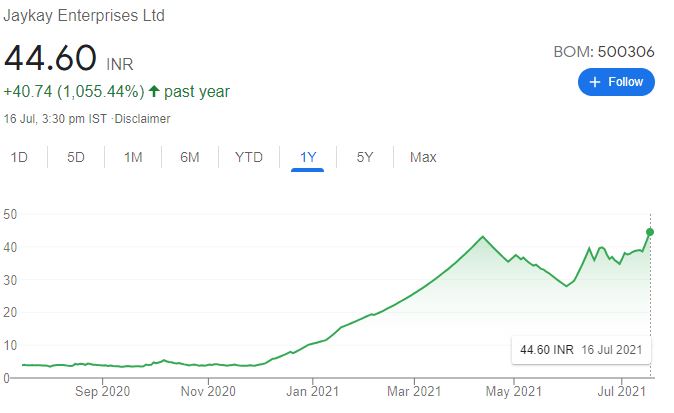

2.Jaykay Enterprises Ltd

Jaykay Enterprises Ltd is a small-cap company. the company is into manufacturing synthetic yarn, fiber, stainless steel sheet, cement, etc. also on 17 July 2020 the stock of Jaykay Enterprise was trading at ₹3.86 and it becomes a multi-bagger. The stock is trading at ₹44.60 in April 2021. This means the stock has given 11.5-time,1,055.44% return in one year

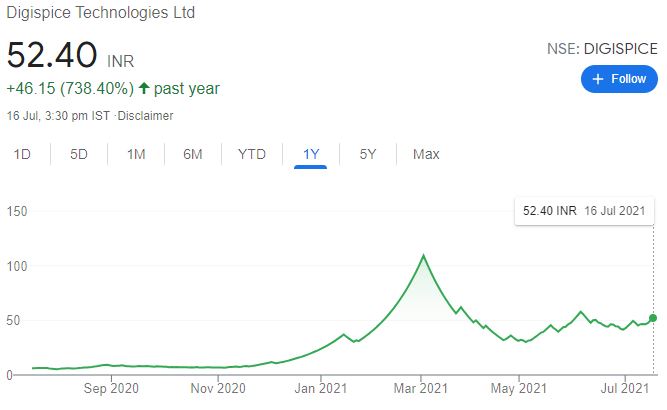

3.Digispice Technologies

Digispice Technologies is an IT digital-based company, that works in analytics, automation, and other value-added services. The stock of Digispice Technologies was trading at nearly ₹6.25 on 17 July 2020. On 16 July l 2021, the stock of Digispice Technologies is trading at ₹52.40. The stock of Digispice Technologies has generated 8.3 times,738.40% returns for the investors in 1 year.

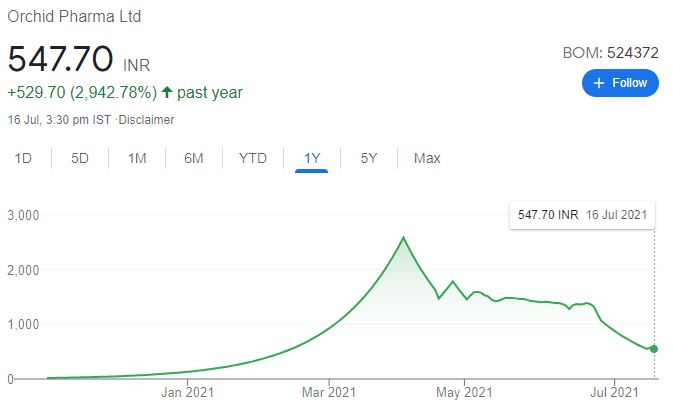

4.Orchid Pharma

Orchid Pharma is a pharmaceutical company. It was a defaulter company and was unable to pay the debt. Dhanuka Laboratories has taken over Orchid Pharma. Relisting of Orchid Pharma was done in Nov 2020 at the price of ₹18. The price of Orchid Pharma shares is continuously growing. The stock has touched ₹2000 in April 2021. The stock of Orchid Pharma has generated more than 7000% returns for the investors. on 16 July 2021, the stock price of orchid pharma is ₹547.70.

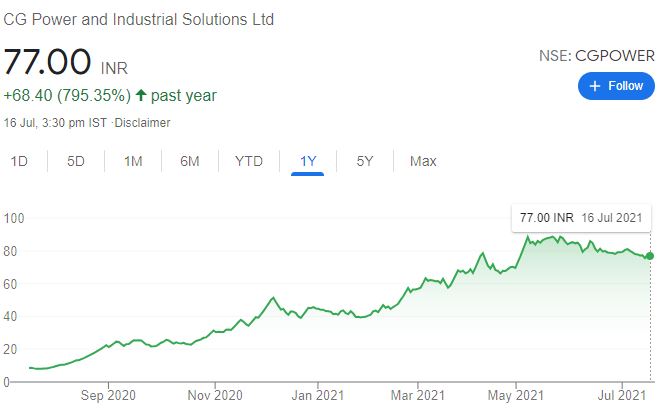

5.CG Power and Industrial Solution

CG Power and Industrial Solution is working in the field of the manufacturing of products related to power generation, transmission, and distribution. The stock of CG Power and Industrial solution was trading at ₹8.60 on 17 July 2020 and within a 1-year time frame, this penny stock has become multi-bagger by giving 795.35%, 8.9 times returns. On 16 April 2021, this stock is trading at ₹77.

Things to keep in mind before you invest in penny stocks

Investing in penny stock is a risky game. you must make a detailed study before you invest in any penny stock. following are the risk associating with the penny stocks.

- Unpredictable – Penny stocks movements are very unpredictable. The price of penny stocks may not go up as we expected. also its movements are tiny. so there will not be any active trading in penny stocks. also With these slow movements, as a result, you may end up making losses in penny stocks.

- Low volume and Less Liquidity – The volume of penny stocks trading is very low. because of its low-scale movements, investors and traders may not show much interest in penny stocks. so the Liquidity in penny stock will be very low in many cases. that means you will not get a buyer to sell your penny stock. most importantly that makes you trapped in a penny stock

- Higher Chance of Fraud – It is very easy to manipulate the pricing of penny stocks with very low capital. so the chance of the fraud activities like money pumping in penny stock is comparatively very high. Penny stock trades at lower prices and volumes so one can easily pump money into the stock and manipulate its price. ultimately the retail investors will lose the money.

- Lack of Information – the most important thing when you consider a penny stock is, its details. many such companies don’t disclose more details to the public. this makes the study about the company and the stock very difficult.

- also, some companies intentionally hide all their details and data b for making a bubble image of their company.

Final Thoughts

Penny Stocks Multibaggers are always been a dream for many of us. Penny stocks are very risky to trade. at the same time, some of the penny stocks performing well too. in this post, we discuss such 5 penny stocks that have become multi-bagger this year. this post is not a suggestion to buy the above mention stocks. make a good study before you invest in any penny stocks since there are risk elements, unlike other quality stocks.

Happy Investing