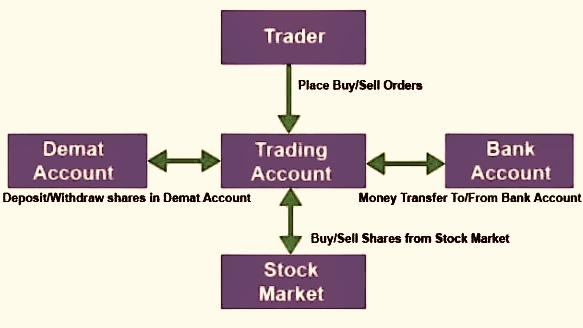

what is a trading account? what is a Demat account? do you know the Difference between Trading & Demat Account? many of the beginners are not aware of this. A stockbroker provides both trading and Demat accounts and the broker will be functioning under the strict monitoring of SEBI .demat and trading accounts are different and both have different roles and duties. in this post, we will discuss the Demat and trading account and their differences.

Also read: What is a stock broker and its types and importance?

Demat account

A Demat account is an account that allows you to hold your shares in an electronic format. A Demat account will convert the physical shares into an electronic form, therefore dematerializing it. when you open a Demat account, you will get a Demat account number to be able to electronically settle your trades. The functioning of a Demat account is similar to that of a bank account, where you keep your money with the option to deposit and withdraw. In your Demat account, the securities are held and accordingly debited and credited. You do not need to have any shares to open a Demat account; In fact, you can even have zero balance in your account.

Trading account

To conduct your stock trading activities you require a trading account. This is because when a company lists its shares in the stock market you can trade the same on an electronic system through a special account known as a trading account. You can get such an account by registering with a firm or a stockbroker. With this account, you are assigned a unique trading ID which grants you access to conduct trading transactions.

Difference between Trading & Demat Account

| Trading Account | Demat Account |

| A Demat account is used to hold the shares in an electronic format that you buy in the share market. | A trading account works as a link between your bank account and Demat account. |

| Demat account will have a unique Demat number, which will be used uniquely Identify your account. | The trading account will have a unique trading number, which will be used to trade in the share market. |

| Demat account can hold financial instruments like equity shares, mutual funds, government securities, and exchange-traded funds. | the trading account only helps in the act of buying and selling of the securities, not used to hold any financial securities. |

| The key role of the Demat account is to ensure the safety of investor’s shares. | The key role of the Trading account is to allow you to carry out trading transactions in the stock market. |

Final Thoughts

As a trader and investor, we must know the basic details of the accounts and services that we are using. in this post, we discussed the difference between Demat and a trading account. I hope this post will give an idea about the Demat and trading account.

Happy Investing.